Contents

If inflation remains sticky, central banks may need to continue raising interest rates and the first repricing may continue. Should the economic downturn gain steam, corporate cash flows may diminish and impact how much investors are willing to pay for those cash flows. In the sections that follow, our most senior investment professionals share our forward views. While we anticipate risks outweighing opportunities in the very near term, the investment pendulum can shift too far and present benefits to patient investors.

JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore, this material is distributed by JPMCB, Singapore branch. JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch . Banking and custody services are provided to you by JPMCB Singapore Branch.

Are Bank Stocks Safe? The Pros and Cons

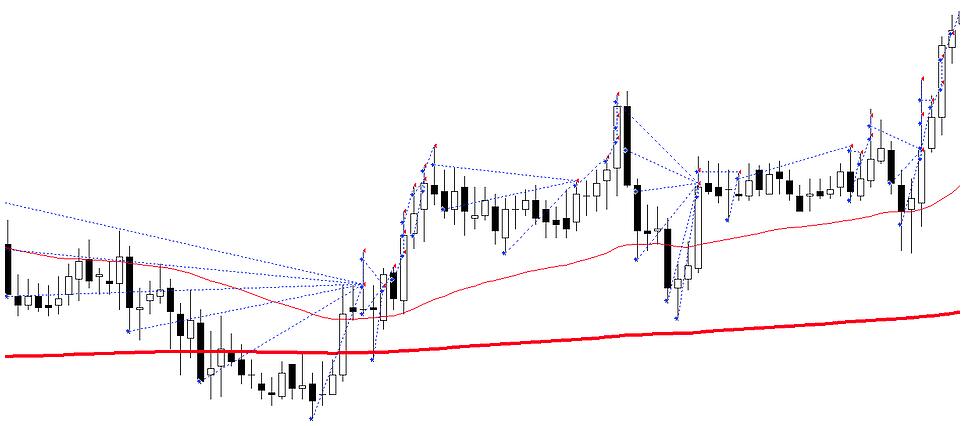

The result is a forward return outlook for financials in general, and bank stocks more specifically, that is considerably more attractive than current valuations suggest. A good time to rotate out of cyclical stocks tends to be at the end of a run of strong economic performance. Some indicators to watch are a flattening yield curve and a levelling off of industrial production. Historically speaking, this stage of the economic cycle is a period of strong performance for energy and consumer staples stocks. Knowing which stage of an economic cycle is taking place involves trading using advanced technical analysis of stocks and prices.

These aggregate dynamics suggest lower economic growth and weakening corporate revenue and earnings. Lower corporate sales and earnings typically translate into price pressure for both stocks and bonds. Consumer banks generally tend to be classified as cyclical stocks, as the demand for their services increases during periods of increased economic activity. Investment banks can have more complex relationships with broader economic cycles though, and some perform best when markets are weakest. Cyclical stocks are essentially equities that see price fluctuations based on economic cycles . During periods of economic growth and rising inflation, cyclical stock prices tend to increase, while during periods of economic slowdown and recessions, they tend to fall.

While structural issues in Italy remain unresolved, the European debt crisis was in large part the result of a perceived lack of common resolution facilities in the face of shocks. That fear was mitigated in 2012 by Draghi’s “whatever it takes” speech and the introduction of the outright monetary transaction mechanism. While the program was never invoked, the evident institutional willingness to prevent a full-scale crisis was enough to rein in spreads at the time. Five other euro area countries also completed and exited bailout programs by 2018. The OMT program of targeted debt purchases, and its attendant conditionality for structural reform, remains an option for Italy together with the ECB’s stated willingness to “flexibly” adjust existing programs.

The reinsurance category, also referred to as insurance-linked securities, offers attractive yield and can aid in portfolio diversification given their limited relationship with the broader economic cycle. High-quality bonds may help manage portfolio risk while slowing economic growth, tightening financial conditions and weak investor sentiment challenge riskier bond prices. Improving earnings growth and tax revenues increased corporate and municipal cash balances used for operations and debt payments. Institutions were also able to issue new debt at low yields in recent years, which locked in cheap borrowing costs and should help limit defaults in coming quarters.

Advantages of Financial Stocks

In the United States, over 20 million workers lost their jobs in a single month, more than double the jobs lost during the entire Global Financial Crisis. Since then, the Fed and the federal government have intervened with historic stimulus that has prevented a damaging and self-reinforcing downturn. St. Louis Fed President James Bullard suggested yesterday that he was in favor of a 50 bps move, and markets are more or less priced aetos broker for one right now. If we don’t see real pushback on the idea from other Federal Open Market Committee members over the coming weeks, we should expect it. In equities, the S&P 500 lost about 2% , but the most important information is probably contained beneath the surface. Mega cap tech stocks underperformed (the NASDAQ 100 was down almost 2.5%), and homebuilders, which usually suffer when interest rates rise, lost over 4%.

This happened because the market started pricing in more rate hikes as the American economy moved from the pandemic. Their shares crashed in 2020 when central banks lowered interest rates. While formally counted as financial stock, in some ways Berkshire Hathawaydefies categorization. Because the financial sector forms the core of the global economy, investors should strongly consider making financial stocks an important part of their portfolios.

The dynamics in Europe were similar, characterized by even more scarce growth, lower inflation, and a somewhat shorter cycle given the double-dip recession with a March 2013 trough. A defensive stock is one that can be relied on to provide consistent returns even during an economic or market downturn. These companies typically offer goods or services that people continue to buy even when the economy isn’t doing well.

It’s also worth addressing how inflation and rising interest rates affect bank stocks, given that inflation has recently hit a 40-year high. In this article we’ll take a look at the banking industry and whether or not bank stocks are statistically sound machine learning for algorithmic trading of financial instruments cyclical investments. One reason for the stronger demand environment is that governments reacted to the pandemic far more robustly by providing support to households and small businesses in a way that was not seen in the GFC period.

What are some cyclical ETFs?

Such securities or instruments are offered and/or sold to you on a private basis only. Public offering of any security, including the shares of the Fund, without previous registration at Brazilian Securities and Exchange Commission–CVM is completely prohibited. Some products or services contained in the materials might not be currently provided by the Brazilian and Mexican platforms. Cyclical stocks are sensitive to changes in underlying economic conditions and are, therefore, volatile. This means they are more similar to growth stocks, which have the potential to outperform the market when it is growing. However, they are also more likely to lose value during downturns, making them riskier than value stocks (that is, non-cyclical or defensive stocks).

- Here, both declined to 1.6% for CPI and 19% for firms planning to raise prices in June 2017.

- Investors may find opportunities in cyclical stocks hard to predict because of the correlation they have to the economy.

- JPM provies investment banking services and commercial banking under the Chase Bankbrand name.

- Performance information may have changed since the time of publication.

- And beyond any one portfolio company or line of business, Berkshire is the corporate incarnation of Warren Buffett, who is without question the most famous living investor.

- Consequently, when investing in cyclical stocks, a long time horizon is necessary to withstand the volatility due to the unpredictable performance of such stocks.

This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don’t own or control the products, services or content found there. Morgan managed strategies will be high in strategies such as, for example, cash and high-quality fixed income, subject to applicable law and any account-specific considerations. Opinions expressed herein may differ from the opinions expressed by other areas of J.P. This material should not be regarded as investment research or a J.P. All market and economic data as of February 2022 and sourced from Bloomberg and FactSet unless otherwise stated.

Meanwhile, the six-week moving average gradually declined to 6.4% on December 14, 2021. Here, card spending rose to an all-time high peak of 21.9% on December 21, 2021. Then card spending dropped to 5.1% on January 4, 2022, before rising back up to 18% on January 25, 2022. The biggest story so far this year in markets is that central banks are going to be fighting realized inflation more aggressively than they have in decades. If a cyclical stock is purchased at the “bottom” and later sold at the “top,” there is greater potential for high returns. But in reality, timing the market correctly is a difficult task that requires much market/industry knowledge .

cyclical bank stocks

Ramsden warns that banking is a very cyclical sector, and analysts are reinforcing predictions of a recession further down the line. “If any confirmation was needed, the strong July employment report showed that the US economy was not in a recession in the first seven months of 2022,” Goldman Sachs analysts said in a Wednesday report. “However, we estimate the risk that this will change over the next 12 months at about one in three.” The report also forecasted a more “mild” recession than what others are expecting. Irrespective of this plausible but otherwise minority view of the yield inversion, they are a net negative for growth outlook. This, coupled with elevated oil prices and the geopolitical uncertainty resulting from the Ukraine war appear to be weighing on bank stocks lately. The big bank stocks have been laggards in the ongoing market pullback, though the Finance sector as a whole has held up relatively well on the back of strength in the insurance and regional bank spaces.

For example, they make money by advising companies that are going public or those that are merging. There is no straight answer to this question owing to the several types of banks that are available. If you already have a taxable brokerage account or a tax-advantaged retirement account, like an individual retirement account , buying financial stocks is easy. But if you don’t have an IRA or a brokerage account, check out Forbes Advisor’s list of the best online brokerages.

Bank stocks in the COVID-19 pandemic

These are stocks of companies that tend to perform similarly in terms of sales and profitability no matter what the economy is doing. Automakers are a good easymarkets review example of the type of companies that tend to be cyclical. When a recession hits, consumers can decide to wait longer to buy new vehicles, so sales fall.

Inflation is likely to remain above long-term average levels as the economy repairs supply constraints and home price and rental increases work through the system. The path of Fed interest rate increases, inflation surprises and corporate margin pressures are key risks to the future economic story. The second repricing reflects how assets react should the global economy weaken. We anticipate slowing consumer activity due to higher prices, waning savings and still-underwhelming labor market participation. Governments have shifted from fiscal support to restraint, dollar strength and weak international demand may stifle exports, and businesses anticipating less consumer activity may withhold aggressive budgeting plans.

She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. The above chart shows the ratio of Invesco KBWB bank ETF and the S&P 500 ETF (ratio KBWB/SPY). Business recognizes inventories are now rising too rapidly due to the slower demand and are having a negative impact on earnings.